Also the amount of GST under Reverse charge is to be paid in cash only and can not be paid from ITC available. SST in Malaysia was introduced to replace GST in 2018.

I Want To Start A New Business On Online Platforms I Require To Apply For Gst How Shall I Get Gst Number Quora

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return.

. Services Tax GST system as it relates to Singapore companies definition of GST registration requirements advantages and disadvantages of GST registration filing GST returns and schemes to. Once you setup recurring sales it will let your customers automatically charge on a regular schedule that you set. Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income.

Financial transactions can also be managed using our detailed reporting modules. FMM asks govt to prioritise economic recovery welcomes GST come-back. FMM asks govt to prioritise economic recovery welcomes GST reinstatement.

Create professional estimates and then convert them to invoices in a click. The GST officer will verify and approve within 15 days in FORM GST REG-15. To remain future-proof members and the accountancy profession must evolve and continue to embrace best practices and technology to leverage on the opportunities emerging from major developing trends such as climate change ESG and sustainability in line with the.

EVENT CALENDAR Check out whats happening. GST berupaya kukuhkan semula ekonomi negara. Other services you will find in the interface.

Subscribe to our newsletter and get news delivered to. John can claim a GST credit of 100 on his activity statement. You can file the GST Invoices for returns through GST portal and claim input tax credit on your business purchases.

Travel Boutique Online offers an interactive online booking interface to travel agents and tour operators allowing them to book travel products like Hotels Flights Travel Insurance Transfers Sightseeing and Holiday Packages and IRCTC simply and quickly. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia. Malaysia perlu bangunkan dasar sistem ambil pekerja asing.

COMPLAINT. Advance paid for reverse charge supplies is also leviable to GST. Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in.

COMPLAINT. Malaysia and the world are preparing for a post-pandemic recovery even as the virus continues to mutate. The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. AGENCY Browse other government agencies and NGOs websites from the list. The change will.

If your company is already GST-registered the MySST system will automatically register your company for SST. For changes in the address of the business the procedure would be as follows. EVENT CALENDAR Check out whats happening.

Submit FORM GST REG-14 along with required documents within 15 days of a change in the address. The net result is that minimum amount of GST payable in a tax period is the amount of reverse charge in that period. This guide provides an overview of the key concepts of Singapores Goods.

Malaysia has a strong educated workforce and English is widely used as a business language. Process of changing or updating the GST registration details. The current tax rate for sales tax is 5 and 10 while the service tax rate is 6.

John can also claim an amount that reflects the decline in value of the photocopier on his tax return. AGENCY Browse other government agencies and NGOs websites from the list. The person making advance payment has to pay tax on.

Malaysia has a well-developed infrastructure. REGISTER LOGIN GST shall be levied and charged on the taxable supply of. The Pejuang chairman said the focus would be on winning in Malay-majority areas targeting 120 parliamentary seats in peninsular Malaysia.

Critical to develop foreign worker recruitment policy and system - FMM. What benefits do I get if I update my GST number with Amazon. Malaysia beat out countries like Australia and the United Kingdom to claim this spot.

Check With Expert GST shall be levied and charged on the taxable supply of goods and services. Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. Send sales orders and confirm each.

An Individual will be. A Complete Guide to Start A Business in Malaysia 2022. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

By updating your GST number with Amazon as a Business customer you can explore lakhs of products with GST Invoices offered by Business sellers. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law.

Is Voluntary Registration Under Gst Beneficial Enterslice

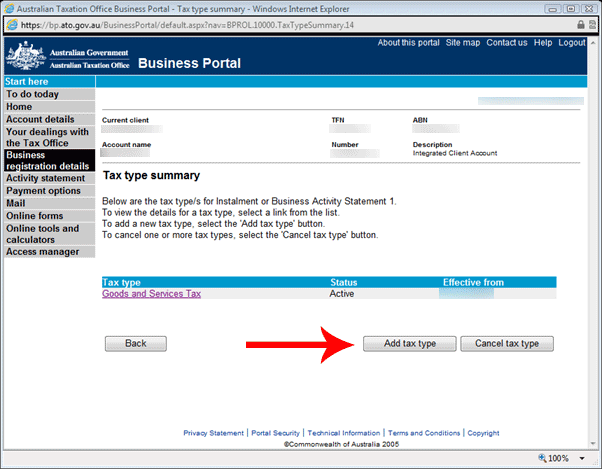

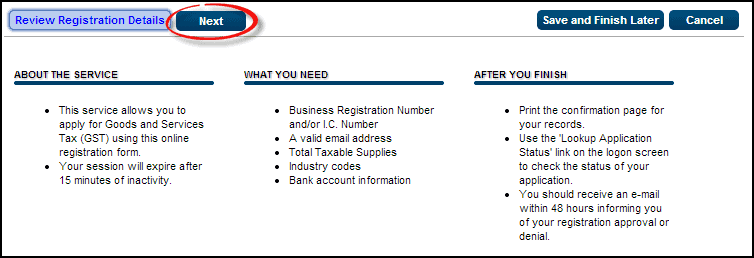

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Is Voluntary Registration Under Gst Beneficial Enterslice

Experience 6 Nights 7 Days Of Absolute Wonder In The Sparkling Urban Landscapes Of Singapore Malaysia At A Jaw Dropping Tourism Travel Tours Tour Packages

Step By Step Guide To Apply For Gst Registration

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Malaysia

Registering For Gst Video Guide Youtube

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling

I Want To Start A New Business On Online Platforms I Require To Apply For Gst How Shall I Get Gst Number Quora

Pin By Uncle Lim On G Newspaper Ads Ads Corporate Design

Gst Registration Self Help Group Register Online Goods And Service Tax

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Malaysia Gst Guide For Businesses

Everything About Gst Registration Of An Llp Ebizfiling

Malaysia Sst Sales And Service Tax A Complete Guide

How To Register For Gst Gst Bas Guide Xero Au

How To Register Gst Gst Registration Online Step By Step Procedure